Missing one payment to a creditor might not seem like a big deal. That is until it is time to search for your next loan and it causes your lender to rethink your loan’s terms—or even your overall eligibility.

Being an absent-minded bill payer is important to credit bureaus and ultimately to your lender. Continually skipping payments can seriously bruise your financial future.

The elements from your credit report that shape your credit scores are called credit score factors. Factors that may affect credit scores include:

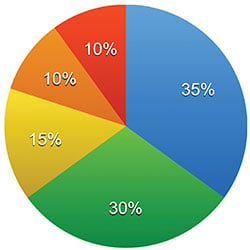

The credit score is calculated by the following weighted factors:

Many people aren’t sure how different types of credit can affect their score. However, with 20% of your FICO score being made up of new credit and types of credit used, it’s a good idea to pay close attention to what kind of credit you’re using and how it can affect your score.

Factors indicate the elements of your credit history that have the greatest effect on your credit score at the time it was calculated. These factors also point out the elements of your credit history that you must address to become more creditworthy over time.

Just one single missed payment can have a negative effect on your credit score. If you’re late with more than one creditor, your credit could take a significant hit. Multiple late payments could be reported several times. Severely late payments, which would be at least 60 days late, will have a heavier impact than payments made within 30 days.

Did you know that late payments stay on your credit history for 7 years?

How to Improve Your Score

If you’ve missed just one payment or multiple payments, then the best method of improving your credit score is being dedicated toward making timely payments from that point on. The biggest impact to your score will be noticed once late payments or collections are reported. Over time, regular payments will result in a gradual improvement in your credit score. Pay every bill on time, pay off collections, and settle any judgments.

Visit Your Heartland Bank Mortgage Lender

Prequalify with Heartland Bank today for your next mortgage. Our experts will help answer any questions about your credit score and guide you to the right mortgage product.

Heartland Bank is a family-owned community bank serving 15 Nebraska locations, committed to improving the lives of our customers, associates, and communities. We’re proud to be a seven-time honoree on American Banker’s Best Banks to Work For list.

Due to recently increased security requirements, we at Heartland Bank are no longer able to support version 10 or older of Internet Explorer. We are sorry for this inconvenience, and encourage you to upgrade to more secure options such as Internet Explorer 11, Google Chrome, or Mozilla Firefox.