.jpg)

Discover the power of saving with Heartland Bank. Whether you're planning for retirement, a dream vacation, or to build a safety net, our range of savings options is designed to empower your financial journey.

At Heartland Bank, we believe in making your financial goals a reality. With competitive interest rates, flexible account options, and personalized service from our dedicated team, we provide the tools and support you need to achieve financial security.

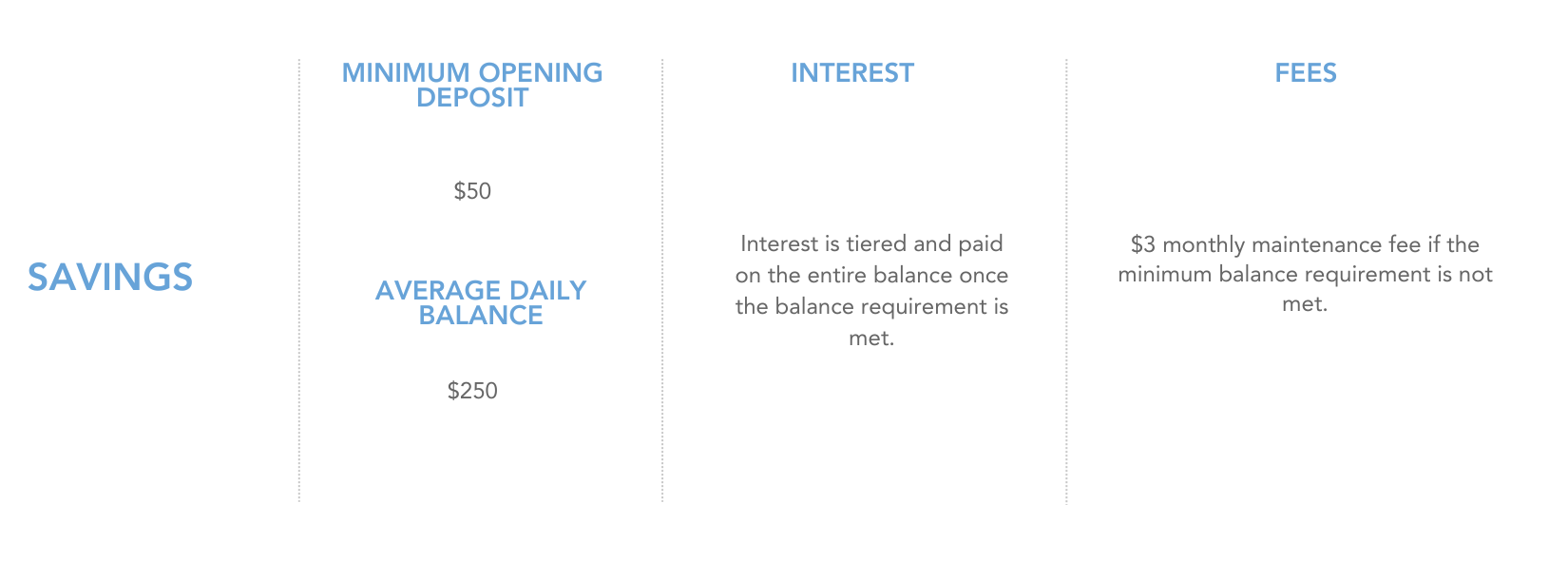

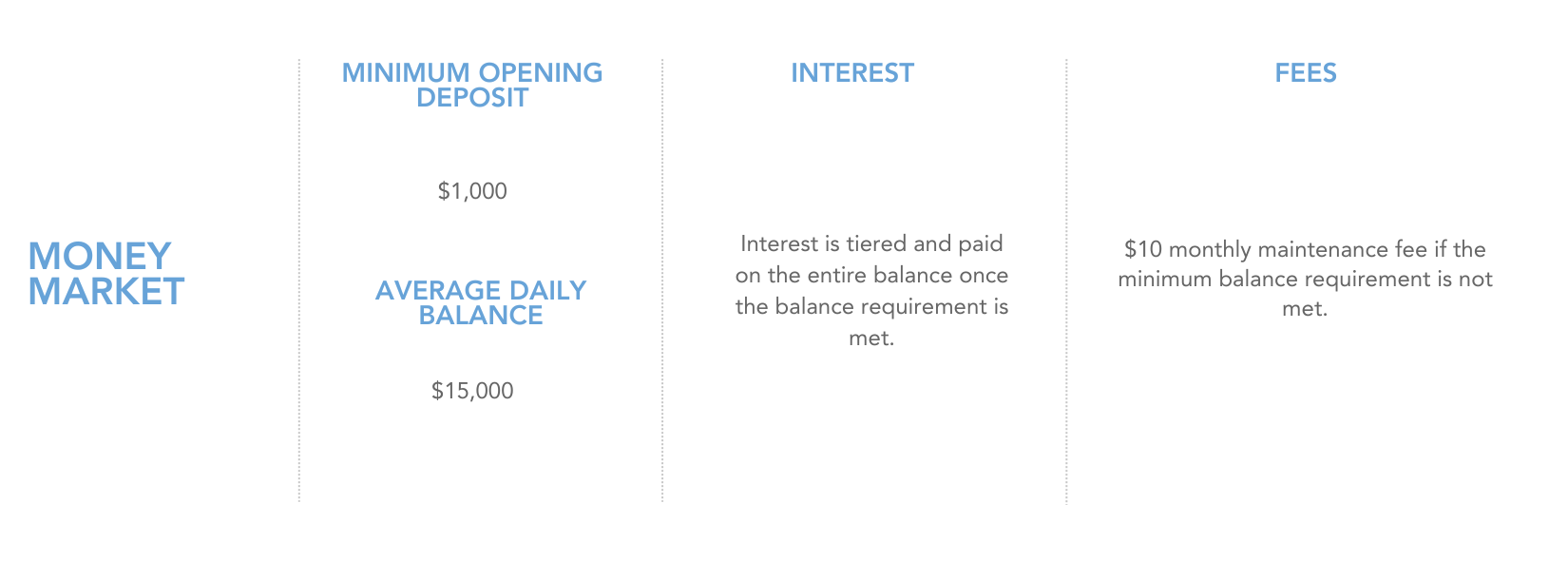

From everyday savings accounts to specialized options like Money Market accounts and Certificates of Deposit (CDs), we have the perfect account to suit your needs. Start saving with confidence today and watch your money grow with us.

Achieve peace of mind as your money grows. With competitive rates and a range of terms, maximize your return with a CD.

Certificates of Deposit, or CDs, are a great way to earn predictable interest on the money you don't need immediately. Our Universal Bankers will work with you to get the best interest rates based on the money you want to invest.

Standard Certificate of Deposit Accounts

Heartland Bank offers a service known as the Certificate of Deposit Account Registry, or CDARS, for account holders depositing more than $250,000 in a CD and wanting full FDIC coverage. The account holder's deposit is broken down into smaller amounts and placed with other member banks. Account holders receive written confirmation of all CDs with the issuing bank's name, maturity dates, interest earned, etc; one monthly statement and one single year-end 1099 that reports taxable income on all CDs involved. For convenience, interest may be added to the certificate, credited to a checking or savings account of the customer's choice, or issued via check.

Invest with someone you know.

Hard work and a lifetime of earnings deserve a financial partner with consistent results so you can focus on what matters most. An Individual Retirement Account, or an IRA, allows you to save for retirement with tax-free growth or on a tax-deferred basis. There are two main types of IRAs - Traditional and Roth - each with different advantages. Heartland Bank offers IRA Certificates of Deposit and IRA Savings Accounts. Talk with a Universal Banker today to learn more.

Due to recently increased security requirements, we at Heartland Bank are no longer able to support version 10 or older of Internet Explorer. We are sorry for this inconvenience, and encourage you to upgrade to more secure options such as Internet Explorer 11, Google Chrome, or Mozilla Firefox.