In partnership with the FHLBank, eligible first-time homebuyers can receive up to $7,500 for down payment or closing cost assistance through the Homeownership Set-Aside Program. The program sets aside funds within the Affordable Housing Program to assist very low, low and moderate income first-time homebuyers. First-time homebuyers must earn at or below 80% of the Area Median Income (AMI) for households purchasing or constructing homes in Colorado, Kansas, Nebraska and Oklahoma. The HSP is provided to households as a forgivable grant with a five-year retention period. Reservations are accepted on a first come, first served basis until the funds run out or through November 30, 2022.

New details on the Homeownership Set-Aside Program for 2022 include:

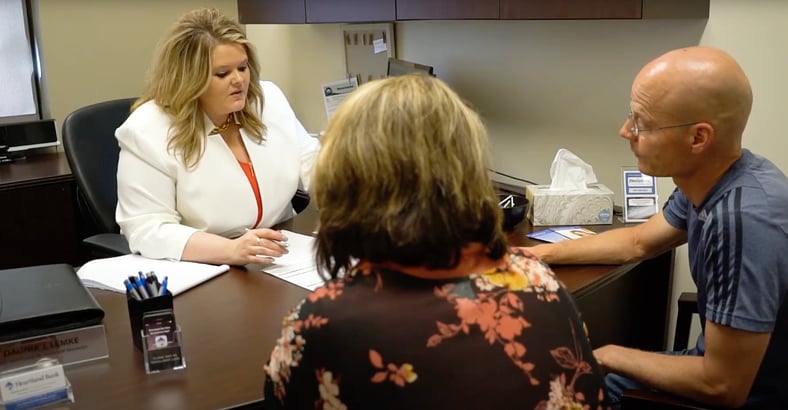

If you in the market to purchase your first home, but are overwhelmed by the process, our experienced and knowledgeable Mortgage Relationship Managers will guide you through the home buying process step by step! We'll weigh the advantages and risks of purchasing a home, calculate what you can afford, get you pre-qualified, check your eligibility for grants and assistance programs, and build a loan solution personalized to you!

Heartland Bank is a family-owned bank located in 13 different communities across the heart of Nebraska. Heartland Bank's vision is to improve the lives of customers, associates, and communities. Voted American Banker 2022 Best Banks to Work For. Learn more at MyHeartland.Bank.

Due to recently increased security requirements, we at Heartland Bank are no longer able to support version 10 or older of Internet Explorer. We are sorry for this inconvenience, and encourage you to upgrade to more secure options such as Internet Explorer 11, Google Chrome, or Mozilla Firefox.

For the second consecutive year, Heartland Bank has been named one of the Best Banks to Work For. Heartland Bank is ranked 30th out of 85 recipients and is the only Nebraska bank to be included in the list.