Mortgage forbearance can help you deal with a temporary financial setback. You'll be able to skip or make reduced payments for a predefined period of time, but interest still accrues.

Concerned about making your next mortgage payment? Forbearance may be an option. Working with your lender to get forbearance helps you avoid late penalties and avert the risk of foreclosure.

If you’ve experienced a financial hardship, here’s what you should know about loan forbearance for mortgages.

» MORE: Mortgage relief programs available during the coronavirus crisis

What is mortgage forbearance?

Mortgage forbearance provides temporary relief by allowing you to make lower monthly payments, or no payment at all, for a specific period of time. It is generally requested by homeowners dealing with an event that impacts their ability to pay their mortgage, like a job loss, natural disaster or major illness.

Mortgage forbearance is not a waiver or a grant; you’ll still owe the amount of those missed or reduced payments, and it may be reported to the credit bureaus. But forbearance is less damaging to your credit score than a missed payment and helps you avoid foreclosure.

» MORE: What to do if you can’t pay your mortgage

How does mortgage forbearance work?

To request forbearance, you’ll have to contact your lender. Lender qualifications can vary, and the type of mortgage you have can also determine what options you’re offered. If you qualify for forbearance, your lender will work with you to set up a forbearance agreement. Terms can include:

- The length of the forbearance period

- The amount of payment required during the forbearance period

- Whether the lender will report the forbearance to credit bureaus

- How you’ll repay the lender after the forbearance period ends

Your loan — including the skipped or lowered payments — will still accrue interest during forbearance.

Your loan — including the skipped or lowered payments — will still accrue interest during forbearance.

When the forbearance period ends, you’ll have to pay your lender back according to previously arranged terms. There are several options for making up the missed amount. With reinstatement, you repay with a lump sum. A repayment plan spreads the payments you missed over an allotted time period by adding a set amount to your regular monthly payment. Another option is to add the repayment amount to the end of the mortgage, lengthening its term.

If your financial hardship lasts longer than you had anticipated, or you don’t have the funds for a reinstatement or repayment plan, ask your lender about a mortgage loan modification. A loan modification changes the terms of your mortgage to help make your payments more manageable.

How long does mortgage forbearance last?

Mortgage forbearance is intended to provide relief while you’re dealing with a short-term financial problem, so it generally does not last more than one year.

Some lenders will ask you to provide them with updates during the forbearance period. If it looks like you will need an extension or a different type of assistance, your lender can explain your options.

» MORE: Ways to reduce your mortgage payment

How do I qualify for mortgage forbearance?

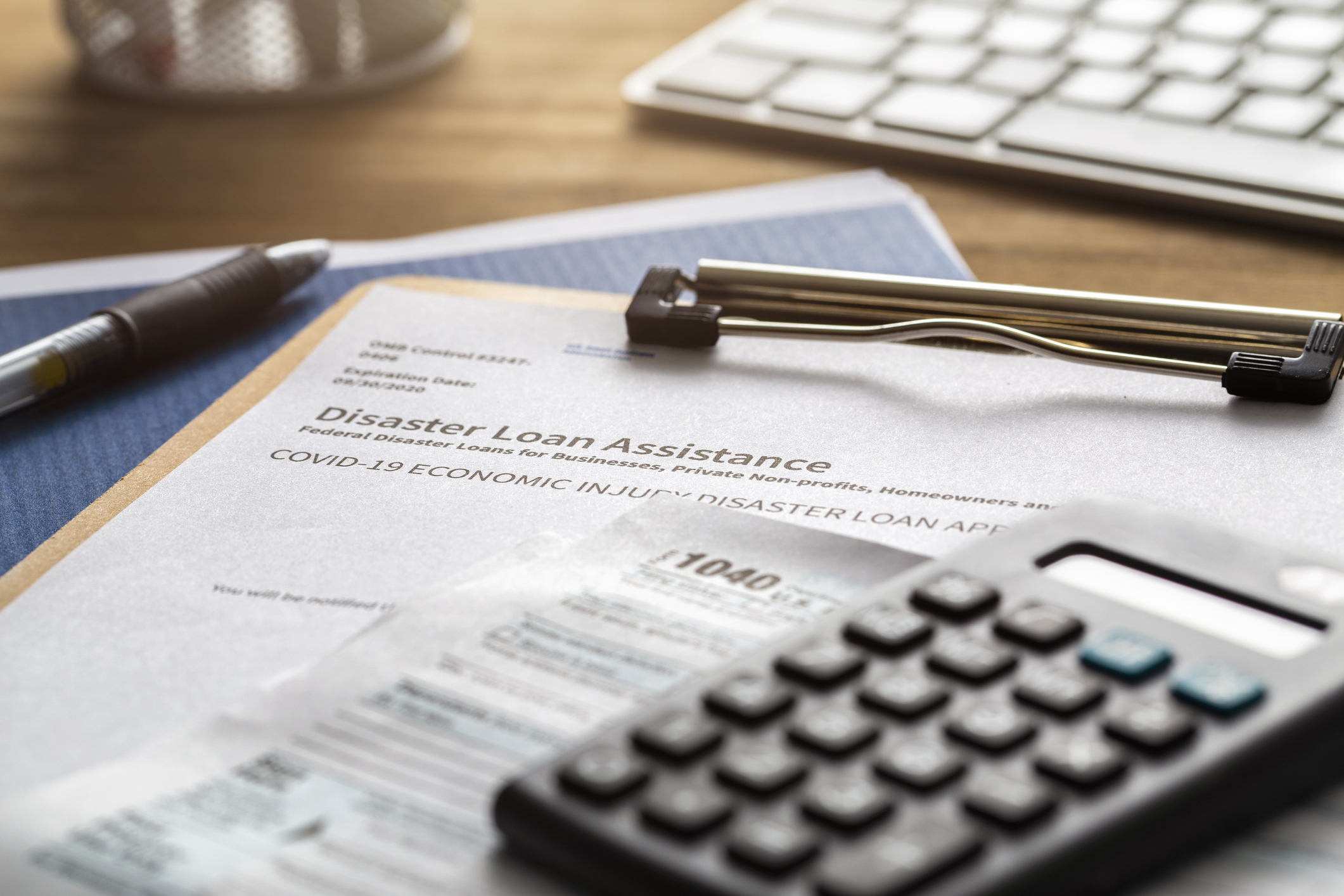

Qualification requirements for mortgage forbearance vary by lender, but in most cases you’ll start by submitting an application. Some lenders allow you to start with an online application; others ask that you call them first. You’ll want to have a few items on hand:

- Your most recent mortgage statement.

- An estimate of your current monthly income.

- An estimate of your current monthly expenses.

- An explanation of your hardship (and, if possible, documents that substantiate your claim).

It’s best to start the process early rather than waiting until you’re about to miss a payment. Some lenders may require you to request assistance within a certain amount of time following an event, like a natural disaster, or a change in circumstances, like filing for unemployment.

If your request for mortgage forbearance is denied, you have the option to formally appeal the decision with your lender. Your application will then be reviewed by a new loan officer (not someone involved in the initial decision), and you’ll receive an updated decision.

How to get mortgage forbearance

Contact your lender or mortgage servicer in order to apply for mortgage forbearance. The phone number on your monthly mortgage statement is a good place to start. You can also check your lender’s website for online resources.

If you want unbiased financial advice about your situation, consider talking to a housing counselor approved by the Department of Housing and Urban Development. You can find a counselor near you on the HUD website. They can weigh in on whether forbearance is the right choice for your situation and explain how different repayment plans would work.

© Copyright 2018 NerdWallet, Inc. All Rights Reserved

This article was produced and provided by Nerdwallet. Nerdwallet gives consumers and small businesses clarity around all of life’s financial decisions. When it comes to credit cards, bank accounts, mortgages, loans or other expenses, consumers make almost all their decisions in the dark. NerdWallet is changing that, helping guide consumers' decisions with free expert content.