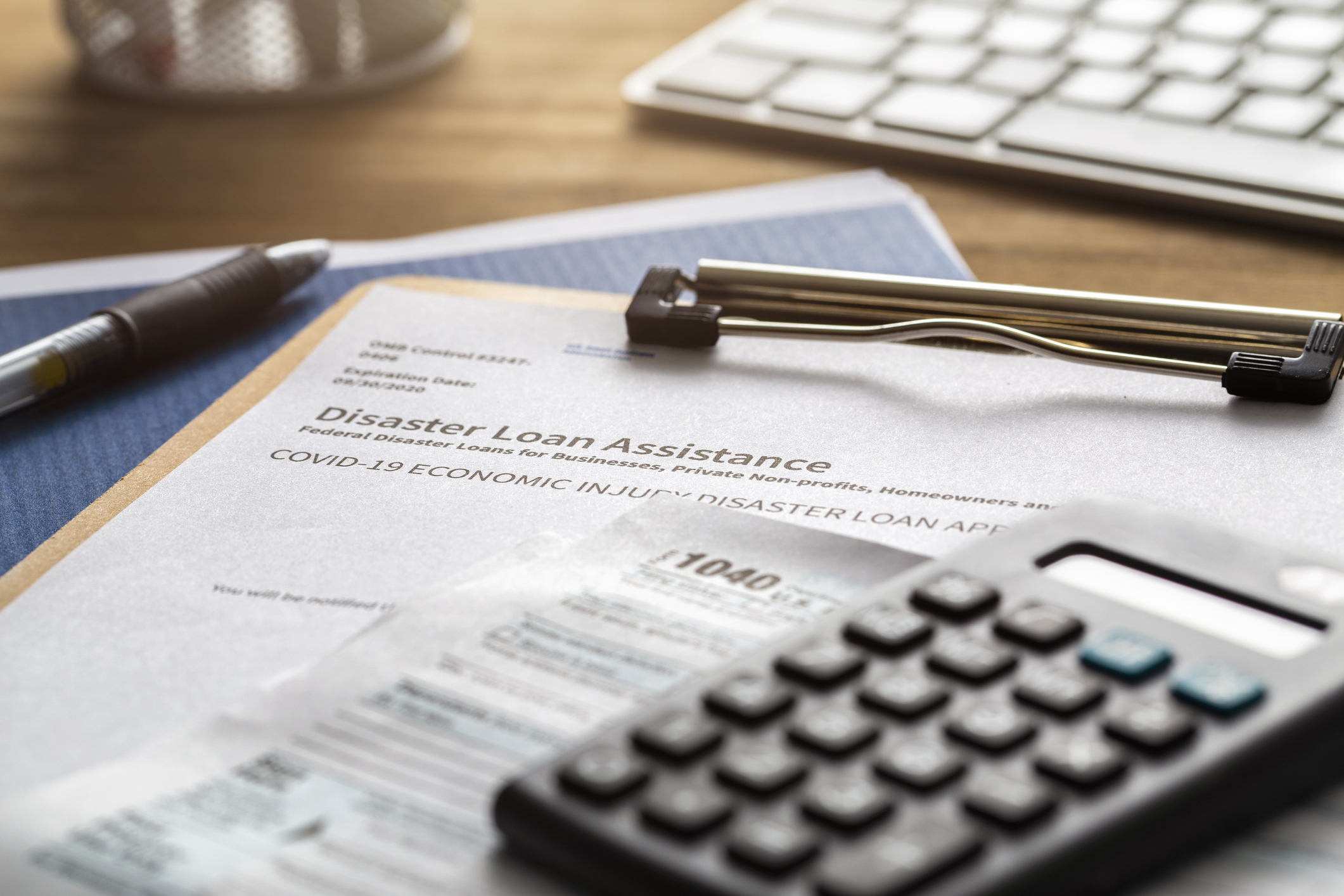

The Closing Disclosure is the final document you’ll see in the mortgage loan process — just prior to that massive pile of paperwork you’ll face. It’s only five pages, yet there are plenty of questions to answer about what exactly it is and how to use it.

What is a Closing Disclosure?

The Closing Disclosure form is issued at least three days before you sign the mortgage documents. It is a final accounting of your loan’s interest rate and fees, mortgage closing costs, your monthly mortgage payment and the grand total of all payments and finance charges.

You will want to compare the Closing Disclosure with the most recent Loan Estimate from your lender, to see if anything substantial has changed.

» MORE: Mortgage closing costs, explained

The Closing Disclosure three-day rule

Having time to discover any changes or errors in the Closing Disclosure form is the reason why there is a “three-day rule.” If there is any discrepancy in the terms or details of the loan, compared with what you last saw on the Loan Estimate, you can contact the lender or settlement agent within three business days and avoid any last-minute drama at closing.

Even things that seem to be minor errors, such as typos or misspellings, should be questioned and corrected ahead of time.

There are three instances where a change can trigger the issuance of a revised Closing Disclosure and a new three-day waiting period:

- A change in the annual percentage rate — the APR — for your loan.

- A prepayment penalty is added to your loan, though these are rare these days.

- Switching your loan product; for example, moving from a fixed to an adjustable-rate mortgage.

» MORE: What is a Loan Estimate?

A Sample Closing Disclosure Form

The Consumer Financial Protection Bureau regulates the mortgage lending industry and provides a sample Closing Disclosure form. Each sample page highlights particular items that you should check for accuracy.

Frequently Asked Questions About the Closing Disclosure

Does Closing Disclosure mean clear to close?

If the Closing Disclosure meets your expectations, you are clear to close. However, the loan doesn’t become official until you sign all the paperwork at closing. And things can change in the three business days before loan settlement.

There are at least six ways to sabotage a mortgage approval, including a change in your credit, job or compensation, and even making a large purchase.

» MORE: Closing on a house: how long it takes, what to expect

What happens after signing the Closing Disclosure?

After you sign the Closing Disclosure, the mortgage paperwork is prepared and all parties involved in the transaction get set to close the loan within three days.

Can you waive the three-day Closing Disclosure?

You can waive your right to a three-day waiting period only if you have a “bona fide personal financial emergency,” the CFPB says. You’ll need to provide a dated and signed written statement to the lender or closing agent describing the urgent matter.

Can closing costs change after a Closing Disclosure?

It’s uncommon but not impossible for closing costs to change after a Closing Disclosure is signed. For example, if you haven’t locked your mortgage rate, it may rise or fall before closing.

It’s more common that some things might have changed in the time between your receiving the Loan Estimate and getting the Closing Disclosure.

You might see differences in the amount of prepaid interest, homeowners insurance premiums, recording fees or third-party charges. These aren’t controlled by the lender and can vary.

Some modifications rise to a level called a “change in circumstances” that can trigger a major adjustment to your closing costs — and the issuance of a new Closing Disclosure.

For example:

- If you modify the amount of your down payment.

- If you change the loan product.

- If the home you’re buying appraises at a value different than expected.

- If there’s a change in your credit or the lender cannot verify income.

What cannot change: Lender or broker fees, other fees that you were not allowed to shop for and transfer taxes — unless you experience one of the “change in circumstances” above.

Regardless of the timing of any changes, whether weeks or days after receiving the Loan Estimate — or after an hour at the closing table — you are well within your rights to take a breath, to read and reread the documents.

And ask as many questions as it takes to understand what you’re signing.

© Copyright 2018 NerdWallet, Inc. All Rights Reserved

This article was produced and provided by Nerdwallet. Nerdwallet gives consumers and small businesses clarity around all of life’s financial decisions. When it comes to credit cards, bank accounts, mortgages, loans or other expenses, consumers make almost all their decisions in the dark. NerdWallet is changing that, helping guide consumers' decisions with free expert content.