Loan terms, rates and products vary from one lending company to the next. During the home buying process, questions are sure to come up, but if this is your first time applying for a mortgage, you may be unsure of what to ask when choosing a lender. We've put together a list of general and loan-specific questions to kickstart the mortgage loan application conversation.

Loan terms, rates and products vary from one lending company to the next. During the home buying process, questions are sure to come up, but if this is your first time applying for a mortgage, you may be unsure of what to ask when choosing a lender. We've put together a list of general and loan-specific questions to kickstart the mortgage loan application conversation.

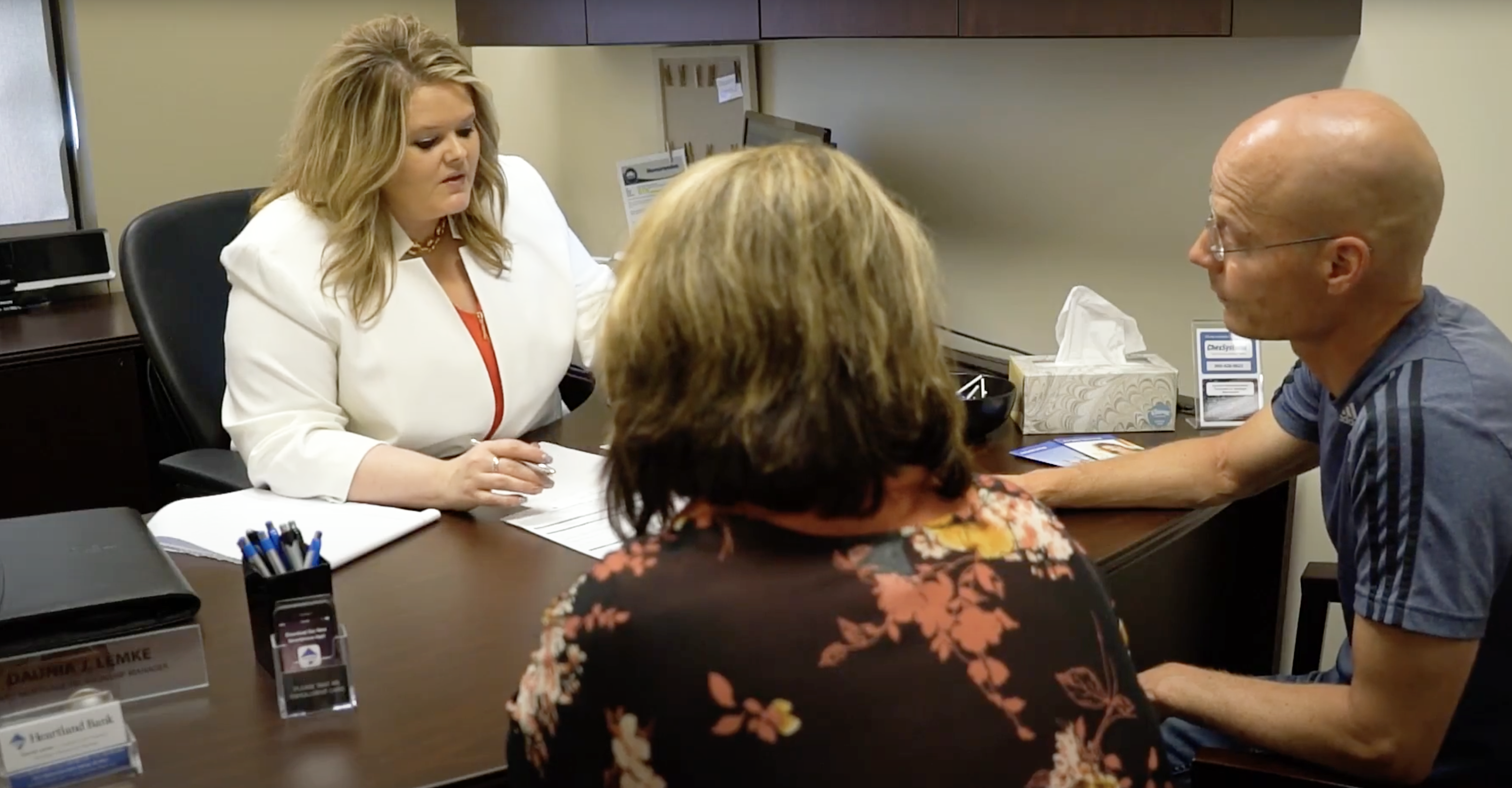

The Mortgage Relationship Managers at Heartland Bank will guide you through the home buying process step by step. We'll weigh the advantages and risks of purchasing a home, calculate what you can afford, get you pre-qualified, and build a loan solution personalized to you.

Download these questions for your loan application meeting!

Due to recently increased security requirements, we at Heartland Bank are no longer able to support version 10 or older of Internet Explorer. We are sorry for this inconvenience, and encourage you to upgrade to more secure options such as Internet Explorer 11, Google Chrome, or Mozilla Firefox.

On the back of solid first-quarter earnings results and healthy economic data releases, the S&P 500 continued its remarkable move higher and closed at a record high for the first time since September 2018, shares Chief Investment Officer Larry Adam.